Getting The Custom Private Equity Asset Managers To Work

Wiki Article

What Does Custom Private Equity Asset Managers Do?

(PE): investing in business that are not publicly traded. About $11 (https://www.domestika.org/en/cpequityamtx). There may be a few things you do not understand about the market.

Partners at PE companies elevate funds and manage the money to generate positive returns for investors, generally with an financial investment horizon of in between four and 7 years. Personal equity firms have a series of financial investment choices. Some are stringent investors or easy financiers entirely based on management to expand the business and create returns.

Since the finest gravitate towards the bigger offers, the center market is a dramatically underserved market. There are extra vendors than there are extremely seasoned and well-positioned finance experts with substantial customer networks and resources to manage a deal. The returns of personal equity are typically seen after a few years.

Unknown Facts About Custom Private Equity Asset Managers

Flying listed below the radar of huge international corporations, several of these tiny companies frequently provide higher-quality customer solution and/or particular niche items and services that are not being offered by the big conglomerates (https://www.easel.ly/infographic/p8uz4g). Such advantages draw in the rate of interest of private equity companies, as they have the understandings and wise to manipulate such possibilities and take the business to the next degree

Personal equity capitalists need to have reputable, capable, and reliable management in place. Most managers at portfolio companies are provided equity and incentive payment structures that reward them for hitting their economic targets. Such positioning of objectives is normally called for before a bargain gets done. Exclusive equity chances are often out of reach for people that can't spend millions of dollars, yet they shouldn't be.

There are laws, such as limitations on the accumulation amount of cash and on the variety of non-accredited financiers. The personal equity service attracts a few of the ideal and brightest in business America, consisting of leading entertainers from great post to read Lot of money 500 companies and elite monitoring consulting firms. Legislation firms can likewise be hiring premises for exclusive equity hires, as accounting and legal skills are needed to full deals, and deals are very looked for after. https://www.pubpub.org/user/madge-stiger.

Indicators on Custom Private Equity Asset Managers You Need To Know

An additional downside is the absence of liquidity; when in a personal equity purchase, it is not very easy to obtain out of or market. With funds under administration currently in the trillions, personal equity firms have come to be appealing investment lorries for well-off individuals and establishments.

For decades, the characteristics of personal equity have actually made the asset course an attractive proposition for those who can take part. Currently that accessibility to personal equity is opening approximately more specific financiers, the untapped potential is becoming a fact. The question to take into consideration is: why should you spend? We'll start with the primary disagreements for purchasing exclusive equity: Just how and why exclusive equity returns have traditionally been greater than various other assets on a variety of levels, Just how consisting of exclusive equity in a portfolio impacts the risk-return profile, by assisting to expand versus market and cyclical risk, After that, we will certainly lay out some crucial considerations and risks for personal equity financiers.

When it involves introducing a new property right into a portfolio, the most basic factor to consider is the risk-return profile of that asset. Historically, private equity has actually displayed returns similar to that of Emerging Market Equities and greater than all other traditional asset courses. Its relatively reduced volatility coupled with its high returns produces an engaging risk-return profile.

More About Custom Private Equity Asset Managers

In reality, private equity fund quartiles have the widest series of returns throughout all different asset courses - as you can see listed below. Technique: Interior price of return (IRR) spreads determined for funds within classic years independently and after that balanced out. Typical IRR was computed bytaking the standard of the average IRR for funds within each vintage year.

The result of adding exclusive equity into a portfolio is - as always - dependent on the profile itself. A Pantheon research from 2015 suggested that including private equity in a portfolio of pure public equity can unlock 3.

On the other hand, the most effective private equity firms have accessibility to an even bigger swimming pool of unknown possibilities that do not face the very same examination, as well as the sources to perform due diligence on them and determine which are worth purchasing (TX Trusted Private Equity Company). Spending at the ground flooring implies greater risk, however, for the business that do be successful, the fund gain from greater returns

Custom Private Equity Asset Managers Can Be Fun For Everyone

Both public and personal equity fund supervisors devote to investing a portion of the fund however there remains a well-trodden problem with aligning interests for public equity fund management: the 'principal-agent problem'. When an investor (the 'principal') employs a public fund manager to take control of their capital (as an 'agent') they pass on control to the manager while maintaining ownership of the assets.

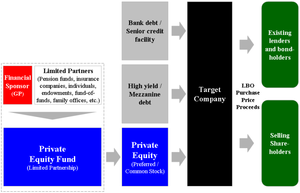

In the instance of personal equity, the General Partner does not simply gain an administration fee. Private equity funds likewise alleviate another type of principal-agent issue.

A public equity financier inevitably wants one thing - for the monitoring to enhance the stock rate and/or pay out dividends. The investor has little to no control over the decision. We revealed above the amount of personal equity methods - specifically bulk buyouts - take control of the running of the business, guaranteeing that the long-term worth of the firm precedes, raising the roi over the life of the fund.

Report this wiki page